Installing solar on your home is a great move for many reasons, one of them being a potential tax break. Learn how to qualify, what expenses are covered, and how to claim the tax credit.

What is the federal solar tax credit?

The federal solar tax credit is a financial incentive the U.S. government offers homeowners for going solar. It’s also known as the Solar Investment Tax Credit (ITC) or the Residential Clean Energy Credit. Simply put, this tax credit pays back up to 30% of the cost of installing a residential solar system.

Some people mistakenly think the government sends you a check for the solar tax credit amount, or you’ll get an up-front discount. But the solar tax credit doesn’t work that way. If you qualify, you’ll see a reduction of the taxes you owe the federal government on your income tax return, for up to 30% of what you paid to go solar.

Do I qualify for the Solar Investment Tax Credit (ITC)?

You may be able to claim the ITC if you meet all of these requirements:

- You own your solar system. You must have purchased it upfront or financed it through a loan.

- You pay federal income taxes, as the ITC credit reduces the amount you owe in federal taxes.

- Your solar system is located at your U.S. residence (that you own and live in)

- The solar system is new or being used for the first time.

If you go solar with a lease or power purchase agreement (PPA), you won’t qualify for the solar tax credit.

What expenses are covered?

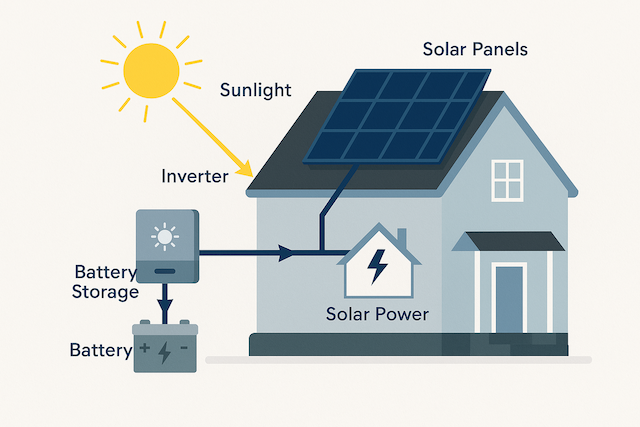

The federal solar tax credit covers:

- The cost of solar panels and residential backup batteries

- Labor costs for onsite preparation or original installation. This includes permitting and inspection fees, and developer costs

- Additional system equipment, like inverters, wiring, and mounting equipment

- Sales taxes on eligible expenses

How can I claim the federal solar tax credit?

If you qualify, you can claim your credit when you file your annual federal income tax return. This credit applies to the tax year when the system was installed, not when it was purchased.

We encourage you to consult with a tax professional for additional guidance.

Are there other incentives for going solar?

Yes! In addition to the federal solar tax credit, each state offers their own mix of incentives and rebates for installing a solar system. Discover incentives in your state:

The tax credit won't last forever

The 30% Solar Investment Tax Credit (ITC) expires after December 31, 2025. The timeline and amount of the credit are set by federal legislation and may be subject to change.

Start your solar journey by talking with a Trinity Solar Expert.

During your free, no-pressure consultation, we’ll share pricing and payment options, including loan and direct purchase options that can help you qualify for the tax credit.